property tax assistance program calgary

This calculator includes tax changes as a result of the 2022 Adjustments to the One Calgary Service Plans and Budgets and changes due to the annual assessment process. Bylaws and public safety.

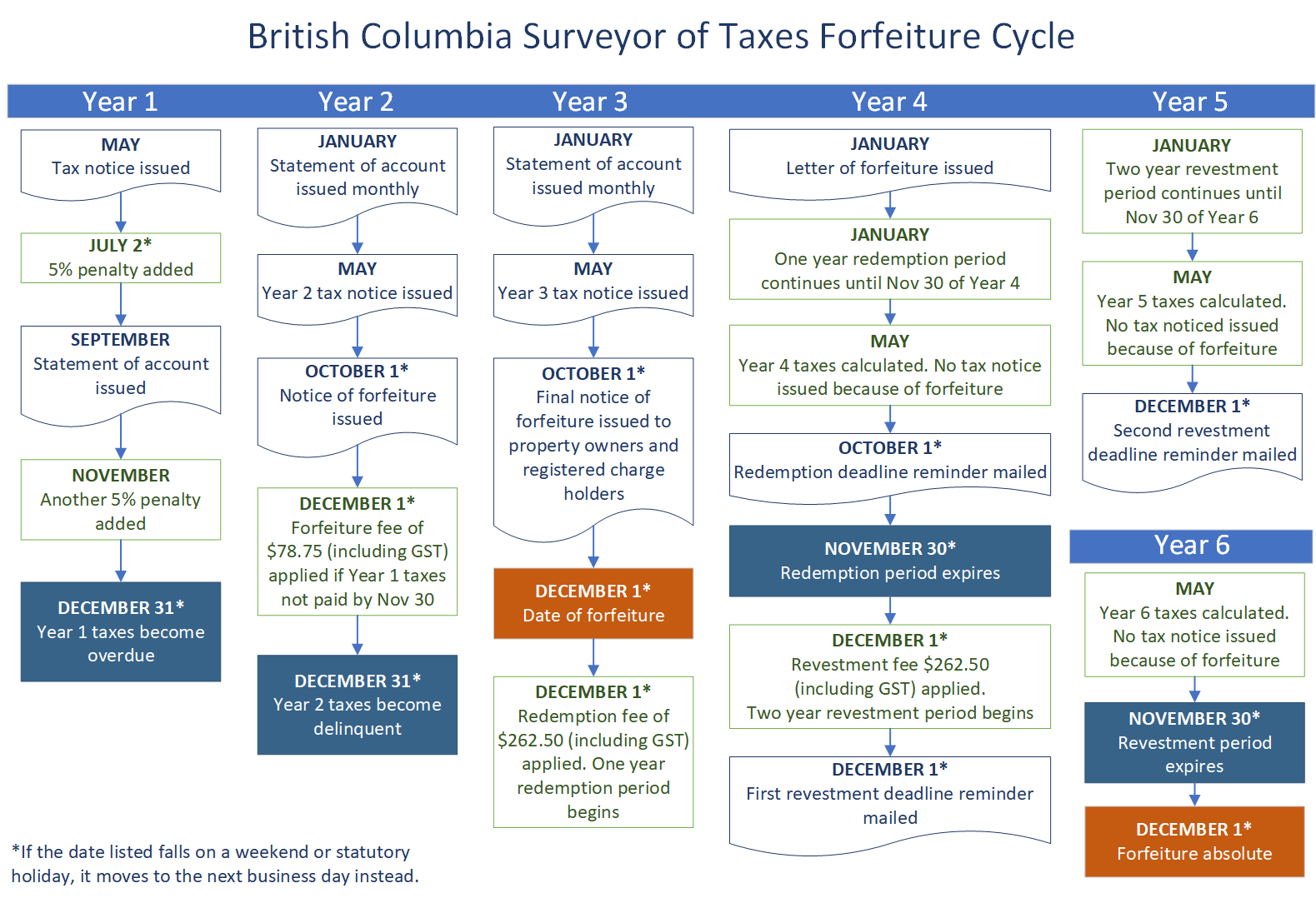

Overdue Rural Property Taxes Province Of British Columbia

Apply for property tax assistance.

. Own no other City of Calgary residential property. To be eligible for this program you must. Property tax bills cover the calendar year.

A creditgrant of the increase on the property tax for eligible low-income Calgarians. Eligible applicants receive a credit on the year-to- year increase on their property tax. Taxes and property assessment.

Own the property for a minimum of. Official web site of The City of Calgary located in Calgary Alberta Canada. Your payment automatically comes out of your.

Fair entry low income assistance. Apply now through Fair Entry and your one. Based on the 2021 Provincial Budget decision.

If you are experiencing financial hardship you can apply for Property Tax Assistance Program The City of Calgary. Social programs and services. Own your own home and reside in your home.

Meet the residency and income guidelines of the Fair Entry Program. Taxes and property assessment. 1 Property Tax Postponement.

This deferred payment is a lien on the. Fair entry low income assistance. If you qualify Seniors Property Tax Deferral Program will pay your residential property taxes directly.

2016 Property Tax Bill Sean Chu. Property owners who have not received a tax bill by the first week of June can request a copy of the bill by visiting property tax document request. Beginning in 2017 and through to 2020 Calgary City Council implemented a tax relief program known as the Non-Residential Phased Tax Program PTP to help mitigate the increase in non-residential property taxes.

SW Calgary T2R 0B7. Bylaws and public safety. If have a limited annual income you may defer the property taxes on your house condo or manufactured home.

Property tax assistance program Property tax assistance. The tax rates are estimated and will be updated when Council approves the Property Tax Bylaw later in the spring. Senior citizens over 65 years of age are eligible for Property Tax Assistance for Seniors Program which offers rebates of tax increases based on 2004 tax.

The combined total income from line 15000 for all adult household members is required. If you bought or owned a 1M condo you may expect to pay an annual property tax of 2926 1M x Property Tax Rate. The combined total income from line 15000 for all adult household members is required.

Official web site of The City of Calgary located in Calgary Alberta Canada. In 2019 the City of Vancouvers official property tax rate was 0256116. Resettlement Assistance Program Independent youth letter a letter from school principal guidance counsellor or Child and Youth Support Program of Alberta Childrens Services Canada Revenue Agency.

Resettlement Assistance Program Independent youth letter a letter from school principal guidance counsellor or Child and Youth Support Program of Alberta Childrens Services Canada Revenue Agency. The City of Calgary Property Tax Assistance Program 2013 181000. Since its introduction the city of Calgary has spent more than 200 million on the PTP.

Apply now through Fair Entry and your one. Own the property for a minimum of one year from date of purchase. Bylaws and public safety.

Property Tax Assistance Program. Property Tax Assistance Program This is an annual program that provides a creditgrant of the increase in property tax for your property. Own your own home and reside in your home.

Property Tax Assistance Program The City of Calgary PO. If you fulfill the program conditions you are eligible for tax rebate. Meet the residency and income guidelines of the Fair Entry Program.

Taxes and property assessment. 204-986-3220 to be eligible for the tipp program your current year property tax account pad from myour financial institution is attached to this application. If you are a residential property owner experiencing financial hardship you may be eligible for a credit on your property tax account through the council-approved 2005 Residential Property Tax Social Support Program.

Application for tax instalment payment plan tipp contact. If you are blind disabled or 62 years of age or older and on limited income you may be eligible for one of the following programs. If you are a residential property owner experiencing financial hardship regardless of age you may be eligible for a creditgrant of the increase on your property tax account.

Fair entry low income assistance. Anyone who is approved will receive an additional rebate from Waste and Recycling Services. Phased Tax Program.

311 or toll free 1-877-311-4974 вђ fax. The Tax Instalment Payment Plan TIPP is a popular program that allows you to pay your property tax on a monthly basis instead of making one payment in June. Property tax assistance program Property tax assistance.

This is done through a low-interest home equity loan with the Government of Alberta. The City of Calgary offers a variety of property tax payment options to pay The City directly or through your bank. A creditgrant of the increase on the property tax for eligible low-income Calgarians.

The City of Calgary offers financial assistance to low-income homeowners who see an increase in their property tax. Social programs and services. Social programs and services.

Further it is important to note that the Citys Property Tax Relief Program is flood-specific and time-limited. This is a development server and. Have experienced an increase in property tax from the previous year.

Property and business taxes. Credit cards cannot be used to pay property tax. Your Effective Property Tax Rate would be 03726 lower than the official property tax rate of 0614770.

The Seniors Property Tax Deferral Program allows eligible senior homeowners to voluntarily defer all or part of their residential property taxes including the education tax portion. Box 2100 Station M 8113 Calgary AB T2P 2M5 403-268-2489 calgaryca Advertisement references resources.

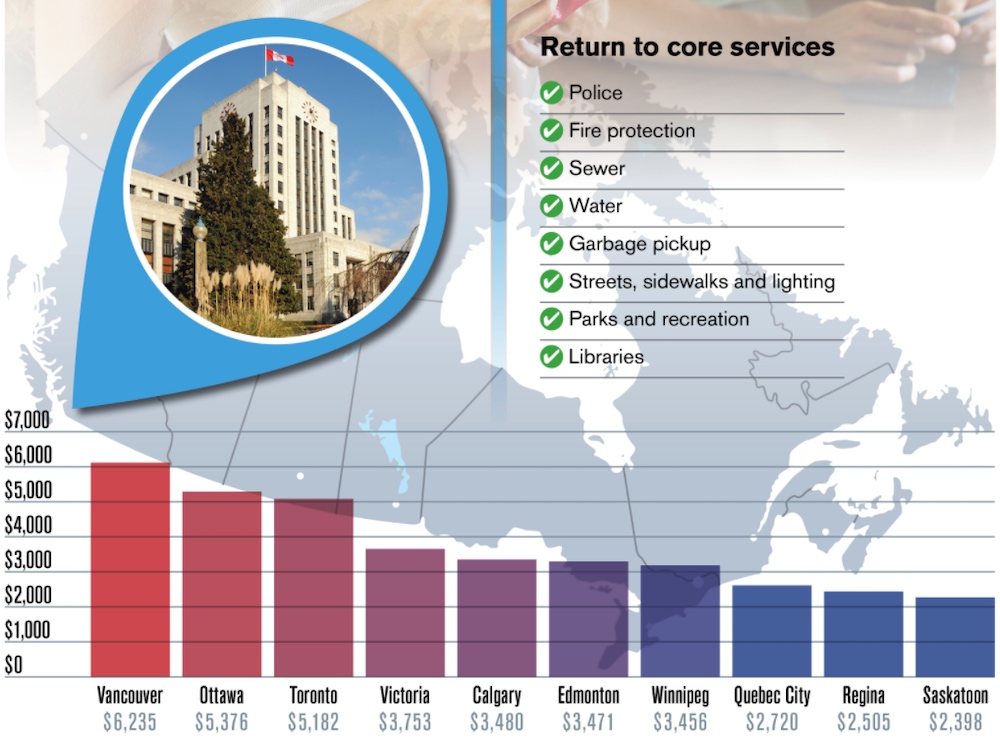

How Our Property Tax And Utility Charges Measures Up Nationally

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

How To Lower Your Property Taxes In Calgary

Guide Property Tax Updates For The Covid 19 Pandemic Our Commercial Real Estate Services Altus Group

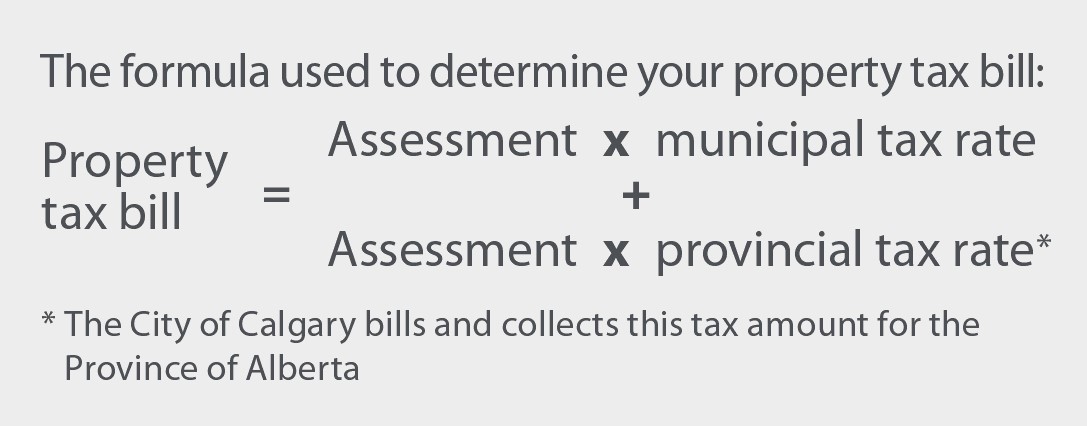

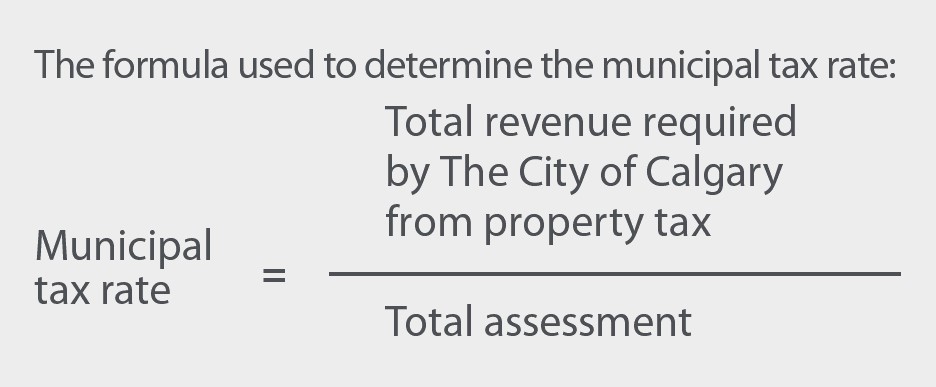

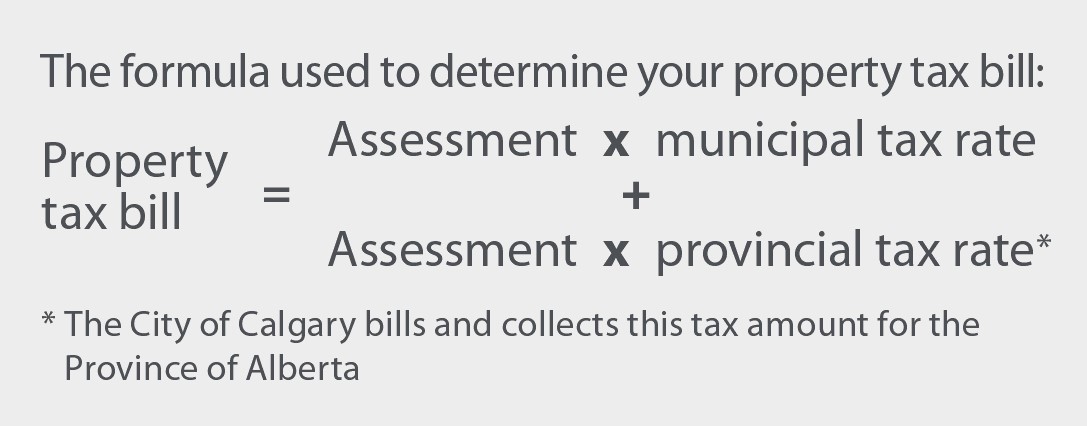

Property Tax Tax Rate And Bill Calculation

Executive Summary Alberta Hotel And Lodging Association Webinar

Can You Claim Property Tax In Nova Scotia Cubetoronto Com

Why Homeowners Not Businesses Are Paying More And More Of The Property Taxes In Calgary Cbc News

Rebalancing Calgary S Property Taxes The School Of Public Policy

Understanding California S Property Taxes

Why Homeowners Not Businesses Are Paying More And More Of The Property Taxes In Calgary Cbc News

Handful Of Communities To See Calgary Property Tax Increase Livewire Calgary

How Our Property Tax And Utility Charges Measures Up Nationally

Property Tax Tax Rate And Bill Calculation

Property Tax Tax Rate And Bill Calculation

Does Alberta Have A Home Owners Grant For Property Taxes Cubetoronto Com

Property Tax Solutions Our Main Task To Help Property Owners Delinquent Property Tax Lampasa Property Tax Lampasas Co Tax Help Tax Preparation Property Tax

Book Keeping Accounting Taxation And Business Consultation In 2020 Accounting Firms Tax Refund Accounting

Vancouver Has The Highest Single Family Property Taxes In Canada Sfu Professor Urbanized