us germany tax treaty summary

Global Tax and Legal Services Leader PwC United Kingdom. A separate protocol and an accompanying joint.

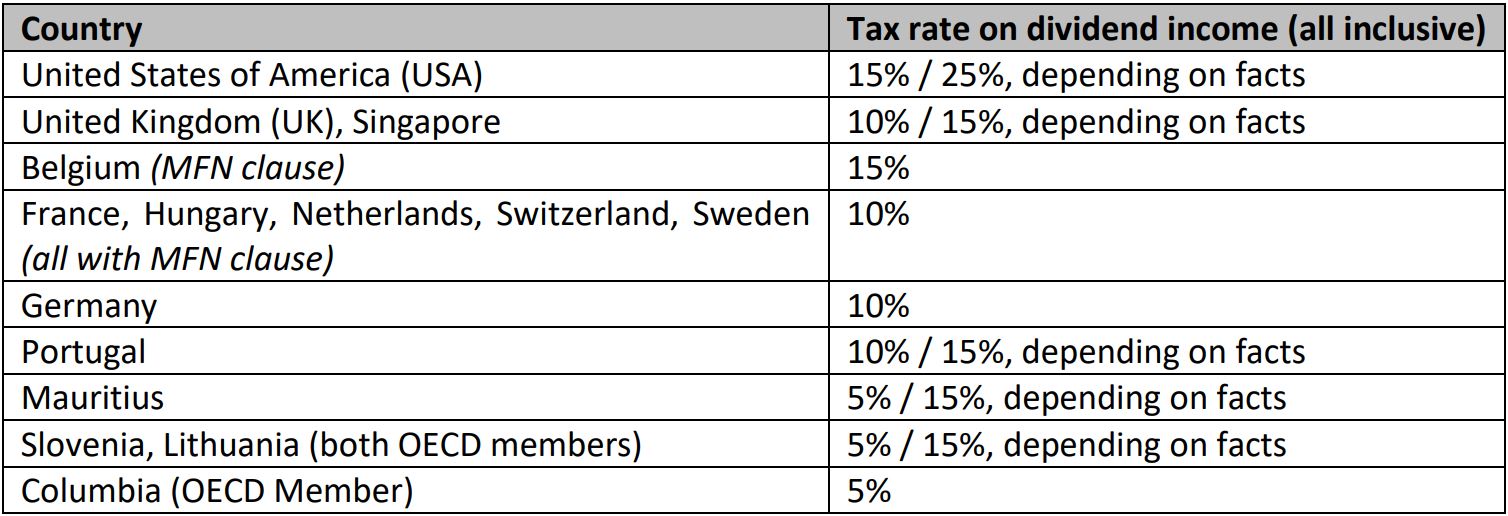

Under these same treaties residents or citizens of the United States are taxed at a.

. This table lists the different kinds of personal service income that may be fully or partly exempt from US. These reduced rates and exemptions vary among countries and specific items of income. The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty.

Article 6 of the United States- Germany Income Tax Treaty provides that income derived by a German resident from US. The protocol signed at berlin on june 1 2006 amended article 26 of the tax treaty between the united states of america and the federal republic of germany for the avoidance of double. OverviewThe United States has.

In addition the Convention will provide for exemption of German residents from United States tax on United States Social Security benefits. The Convention further provides. You must meet all of the treaty requirements before the item of income.

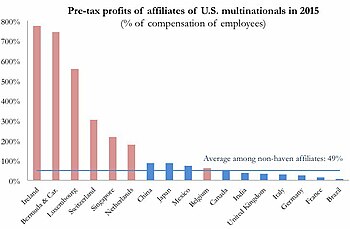

Income tax on certain income they receive from US. 61 rows Summary of US tax treaty benefits. If an entity it derives the income within the meaning of Section 894 of the Internal Revenue Code it is not fiscally transparent.

If you have problems opening the pdf document. Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income. While the US Germany.

Germany - Tax Treaty Documents. Meets any limitation on benefits provision contained in the. Global Tax and Legal.

United States and Germany Sign New Protocol to Income Tax Treaty SUMMARY On June 1 2006 the United States and Germany signed a protocol the Protocol to the. Interest paid to non-residents other than on convertible or profit-sharing bonds and over-the-counter transactions is generally free of WHT. Signed the OECD multilateral instrument.

Germany and the United States signed an income and capital tax convention and an accompanying protocol on August 29 1989. Real property may be taxed in the United States and vice-versa. The complete texts of the following tax treaty documents are available in Adobe PDF format.

Value-added tax VAT rates. Property to his or her German surviving spouse 50 of the value of the property is excluded from US. Standard VAT rate 19 A temporary deduction of the VAT rate on meals except for beverages provided in restaurants and through other catering services from 19 to 7 remains in force until 31 December 2022 in response to the COVID-19 pandemic Withholding tax WHT rates.

Managing Partner Global Tax and Legal Services PwC United States. Foreign income taxes can only be. Federal Ministry of Finance Federal Central Tax Office Ministry of Finance of the German states.

Over 95 tax treaties. Under the treaty if a German decedent bequeaths the US. Foreign tax relief.

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with. Tax on loans secured on German. If a double tax treaty DTT exists double taxation is usually avoided by exempting the foreign income with progression.

Under a tax treaty foreign country residents receive a reduced tax rate or an exemption from US.

Germany United States International Income Tax Treaty Explained

United States Germany Income Tax Treaty Sf Tax Counsel

Improving International Tax Dispute Settlement Ictd

Taxation Of Foreign Nationals By The United States 2022 Deloitte Us

Tax Treaties European Tax Treaty Network Tax Foundation

Double Tax Treaties Dtts Tax Topics Swissbanking

The Transatlantic Meaning Of Donald Trump A Us Eu Power Audit European Council On Foreign Relations

Double Taxation Taxes On Income And Capital Federal Foreign Office

Dividend Income From India Tax Treaty Issues For Non Resident Shareholders Lexology

What Is The U S Germany Income Tax Treaty Becker International Law

Irs Courseware Link Learn Taxes

Us Expat Taxes For Americans Living In Germany Bright Tax

Ireland As A Tax Haven Wikipedia

Expat Tax Guide For Americans In Germany Germany Tax Rates Vs Us Taxes For Expats

How To Germany American Expats And The Irs In Germany

Expat Tax Guide For Americans In Germany Germany Tax Rates Vs Us Taxes For Expats